Handling the transfer of a car from a deceased person’s estate in South Africa can be a challenging task, especially during a difficult time. This guide simplifies the process, outlining each step and providing useful tips for family members, executors, and beneficiaries to ensure a seamless transfer of vehicle ownership from a deceased estate.

Step 1: Obtain the executor’s permission 📑

The first step in transferring a car from a deceased’s estate is to identify the executor of the estate. The executor is legally responsible for managing and distributing the deceased’s assets, including vehicles. You will need a Letter of Executorship (or Letter of Authority if the estate’s value is below a certain threshold) from the Master of the High Court to authorize the transfer.

💡Tip: Keep certified copies of the Letters of Executorship, as they will be needed for various processes related to the estate.

Step 2: Gather the required documents 📝

To proceed with the transfer, specific documents must be in order. These include:

- Certified Copy of the Death Certificate: This officially records the deceased’s passing.

- Letter of Executorship/Authority: Confirms the executor’s role.

- Vehicle Registration Certificate: This document should ideally be located among the deceased’s papers. If missing, the executor may need to apply for a duplicate at the licensing department.

- ID of the Deceased: A certified copy of the deceased’s ID is required for the transfer.

- Executor’s ID: A certified copy of the executor’s identification is also needed.

💡Tip: Make sure all documents are certified to prevent any delays at the licensing office.

Step 3: Obtain a Roadworthy Certificate (if needed) 🚗

If the vehicle is to be sold or transferred to a new owner, a Roadworthy Certificate is often necessary. This certificate is required if the vehicle’s current roadworthy status is older than 60 days, which ensures it meets South Africa’s safety standards. Have the vehicle tested by a company such as Dekra.

💡Tip: Arrange the inspection early to avoid delays, as it may take time to schedule and complete.

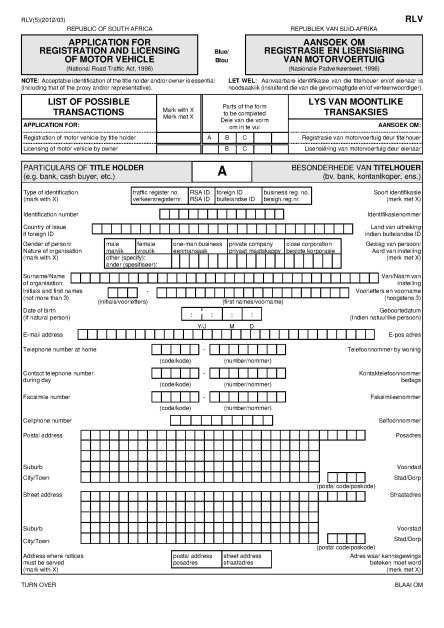

Step 4: Complete the Application for Registration and Licensing of Motor Vehicle (Form RLV) ✍

The executor or intended new owner needs to complete the Application for Registration and Licensing of Motor Vehicle (Form RLV). This form is available at any local vehicle licensing office and can also be downloaded from the eNatis website.

💡Tip: Ensure the RLV form is filled out accurately, as mistakes can delay the process.

Step 5: Notify the licensing office of Change of Ownership 🔀

The executor must submit a Notification of Change of Ownership form (NCO), notifying the licensing office that the vehicle is being transferred from a deceased estate. Both the executor and the new owner should sign this document to validate the change. This form is available at any local vehicle licensing office and can also be downloaded from the eNatis website.

Step 6: Visit the licensing office to submit documentation 🪪

With all documents ready, visit your local licensing office. Submit the following:

- Certified Death Certificate

- Letter of Executorship/Authority

- Vehicle Registration Certificate

- Executor and New Owner’s IDs

- Completed RLV Form

- NCO Form

- Roadworthy Certificate (if required)

Some provinces may have additional forms or requirements, so check with your local office.

Step 7: Pay transfer fees 💰

The registration process includes an administrative fee, which varies by province. Ensure you have the correct amount in cash or card form to avoid any disruptions.

Step 8: Receive the updated Registration Certificate 🔄

Once all the paperwork is processed and fees are paid, the licensing office will issue a new Vehicle Registration Certificate (RC1) under the new owner’s name. This may take a few days to a few weeks, depending on the office’s processing times.

Step 9: Update insurance and licensing 🚨

The new owner should update the vehicle’s insurance policy to reflect their ownership. Additionally, if the vehicle’s license has expired, it should be renewed immediately to avoid fines.

Final Thoughts

Transferring a vehicle from a deceased estate can seem complicated, but with the correct documents and a clear understanding of the steps, the process can be managed efficiently. Following this guide helps ensure a smooth transition, keeping the vehicle legally registered and compliant with South African regulations. Read more buying advice here.

My husband passed away in March 2023. We were married in community of property and I am the sole beneficiary of his estate which is not yet wound up. I am a joint executor with his lawyers. Our 2 vehicles were both registered in his name. Will I have to have them roadworthied in order to transfer them to my name? I live in Wellington Western Cape (Drakenstein Municipality)

I would appreciate your advice on this matter.

Hello Moira,

I’m sorry for your loss.

You will need to have them roadworthied before the transfer can be completed. You should complete the roadworthy test shortly before the change of ownership – and bear in mind that roadworthy certificates are only valid for 60 days.

It is a straightforward and simple procedure. I found a few roadworthy test centres on Google in Wellington that you can use.

Once again, terribly sorry for your loss.

Kind Regards,

Evan